Passive Investments: 5 Net leased deals that caught my eye

Here are 5 Net leased deals that caught my eye this past week as great passive investments....

Starbucks Texas $1,120,000 7.5% "BBB+" Credit Rating, Out parcel to 191,000 SF Ross & Bealls Anchored Center

NNN AT&T Strip Center Raleigh, NC $4,744,800 Retail shopping center in Raleigh, North Carolina.

AutoZone Office Building CA (Sacramento) $15,700,000 6.64% Autozone Net Leased Office Building Guaranteed by AutoZone, Inc (NYSE: AZO). S&P Rated BBB investment In Rent Class A Build-to-Suit Completed in 2009. Mission Critical Facilty-Headquarter of ALLDATA,Wholly Owned Subsidiary of Autozone.

AT&T Zachary, LA $19,03,000 8% 10 Year Lease (2011 Construction) 10% Increase Every Five year "A" Standard and Poor Credit Rating

Whirlpool Distribution Building Omaha, NE $2,200,000 8.75% Incredible location in one of Omaha’s top Industrial park’s near 96th and L street.

Contact Thomas Morgan, CCIM for more details on any of the above passive investments and net leased NNN property deals via email or phone at 1.866.539.1777

Deals are a sampling of available NNN inventory from around the US and are for reference only.

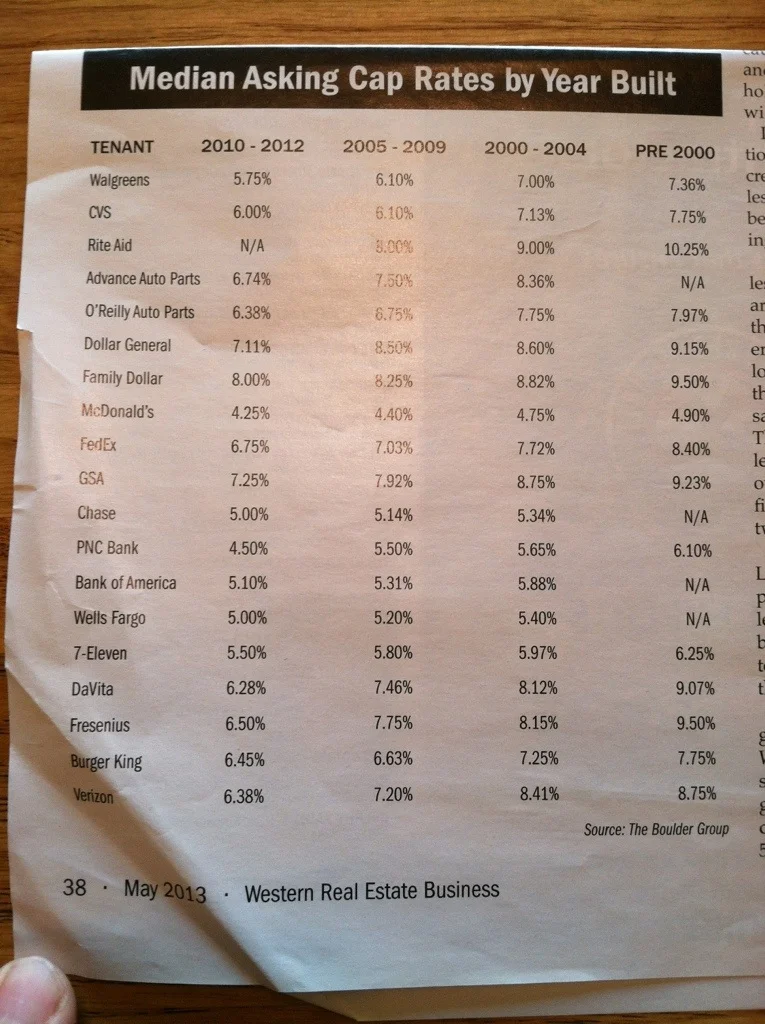

Current NNN Cap Rates

Here is a great chart of current asking cap rates for single tenant NNN deals. It is sorted by NNN tenant and NNN year built. Originally published in Western Real Estate Business May 2013. Data by Boulder Group.

"Ignore the Recession" - More reasons to buy a Net Leased TSC

TSC is one of my favorite NNN tenants. Nice buildings, great locations, solid financials, long leases, low management for owners; the list goes on and on. ABC News Nightline did a segment this week of why TSC is a "Recession Proof Retailer". TSC's internal strategy has been to "ignore the recession". It appears to have worked.

Net Lease Properties a Hot Commodity Due to Low Yields on Alternative Investments

Today a 10-year government bond would yield a return of approximately 1.5 percent, while a net lease building offers returns from 5 percent to 8.5 percent or greater. There is also little risk associated with class-A net lease properties—as long as the location is good and the building is well-maintained there will always be tenants willing to sign leases even if the existing occupant leaves. This inspires greater confidence in conservative investors than the recently volatile stock market.

SOLD: $12M Walgreens Property

In August, TMO represented the buyer of a northern California NNN Walgreens property. The property sold for $12,184,846 and is leased on an absolute triple net basis to Walgreens (Ticker: WAG) on a 75 year lease with 24 firm years remaining. The buyer was a privately held real estate investment company from New York who was in a 1031 Exchange. The seller was represented by Capital Pacific. The low leverage transaction was financed by Lafayette Life Insurance Company which was placed by Ed Isola from Isola & Associates.

For further details about the cap rate and financing terms, please contact Thomas Morgan, CCIM via email or toll free at 1-866-539-1777.

We sell Walgreens throughout the entire U.S.! Ask about a FREE no obligation NNN consultation.

Contact Thomas Morgan, CCIM to find out more about the benefits of Walgreens Real Estate Investments.

1.866.539.1777

This week's NNN deals

SOLD: TMO sells another net leased TSC

TMO has just closed on the sale of a NNN property in NC that is net leased to Tractor Supply Company. The sale price was just over $3.2M nearing an 8% cap rate. TMO represented the buyer who is a private investor in a 1031 Exchange. The seller was represented by SJC.

The property is leased on an absolute net basis to TSC for another 10 years ensuring a long term passive investment for the owner. Tractor Supply Company is an operator of retail farm and ranch stores in the United States.

TMO provides clients with passive investment opportunities like this around the U.S. Net leased properties give investors peace of mind, long term stable cash flows with very low risk.

Contact TMO for a free investment evaluation via email or toll free at 1.866.539.1777

SOLD: net leased Tractor Supply

TMO is pleased to have represented a private investor in the purchase of a NNN leased Tractor Supply property in Texas. The all cash transaction closed in under 30 days for $2,242,500 at a cap rate of 8%.

"Tractor Supply (TSCO) is a great reliable tenant with a solid business model which provides my client with peace of mind for years to come." says Thomas Morgan, CCIM. "TSC's may be in smaller markets but that is where their customers are and they serve the rural farming towns perfectly. Compared to a NNN Walgreens or fast food NNN investment, TSC's have a lot of residual value in the real estate as they are on large lots, usually 4-5 acres and have decent size buildings of around 20,000 sf built of block."

Marcus Millichap represented the Seller.

What does NNN stand for in real estate?

The "What does NNN stand for in real estate?" has moved to this page: What is Triple Net NNN? Triple net lease definition

See all NNN and Triple Net Posts