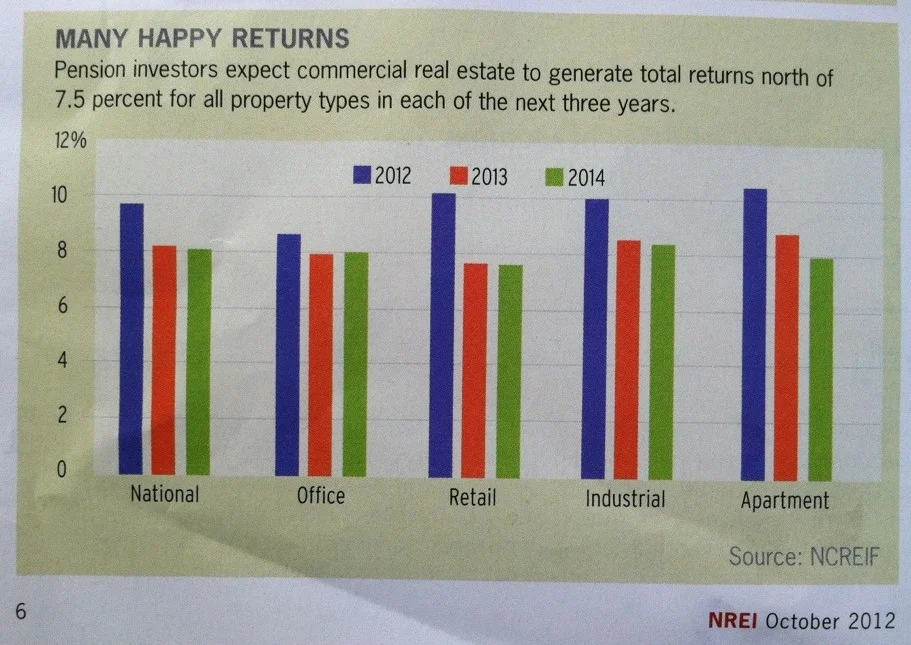

Pension funds expect commercial real estate to generate annual returns of over 7.5% for next three years. Expected yields are higher for apartments and industrial commercial real estate.

National Real Estate Investor magazine reported this study by NCREIF:

Featured