If you're on the hunt for lucrative investment opportunities, considering a Starbucks NNN (Triple Net Lease) for sale could be a smart move. With their established brand, consistent customer base, and a lease structure that offers a hands-off approach for investors, Starbucks NNN properties are often seen as a prime choice in the commercial real estate market. In this guide, we'll delve into the benefits of investing in Starbucks NNN properties and provide you with valuable insights to make an informed decision.

Understanding Starbucks NNN Properties:

Starbucks, a global coffee giant, is a well-known name not just for its beverages, but also for its stable presence in the commercial real estate landscape. NNN leases, in particular, offer an attractive opportunity for investors seeking reliable income streams. With an NNN lease, the tenant (Starbucks, in this case) assumes responsibility for property taxes, insurance, and maintenance costs, relieving the property owner of these financial burdens. This lease structure allows investors to enjoy a passive income flow without the day-to-day hassles of property management.

Why Invest in Starbucks NNN Properties:

1. Brand Recognition: Starbucks has a loyal and widespread customer base. Their strong brand reputation can contribute to steady foot traffic and sales, ensuring a consistent income stream for property owners.

2. Long-Term Stability: Starbucks typically signs long-term leases, often 10 to 20 years, providing investors with a reliable and predictable income source.

3. Hands-Off Investment: The NNN lease model means that investors have minimal involvement in property management. Starbucks takes care of property-related expenses, allowing owners to enjoy a truly passive investment.

4. Prime Locations: Starbucks strategically chooses locations with high visibility and heavy foot traffic. Investing in a Starbucks NNN property means owning real estate in a prime location.

Factors to Consider about Starbucks NNN 1031 Properties

While Starbucks NNN properties offer several advantages, it's essential to conduct thorough research before making a decision. Here are a few factors to consider:

1. Location: Even though Starbucks tends to choose prime locations, it's important to assess the specific area's demographics, growth potential, and competition.

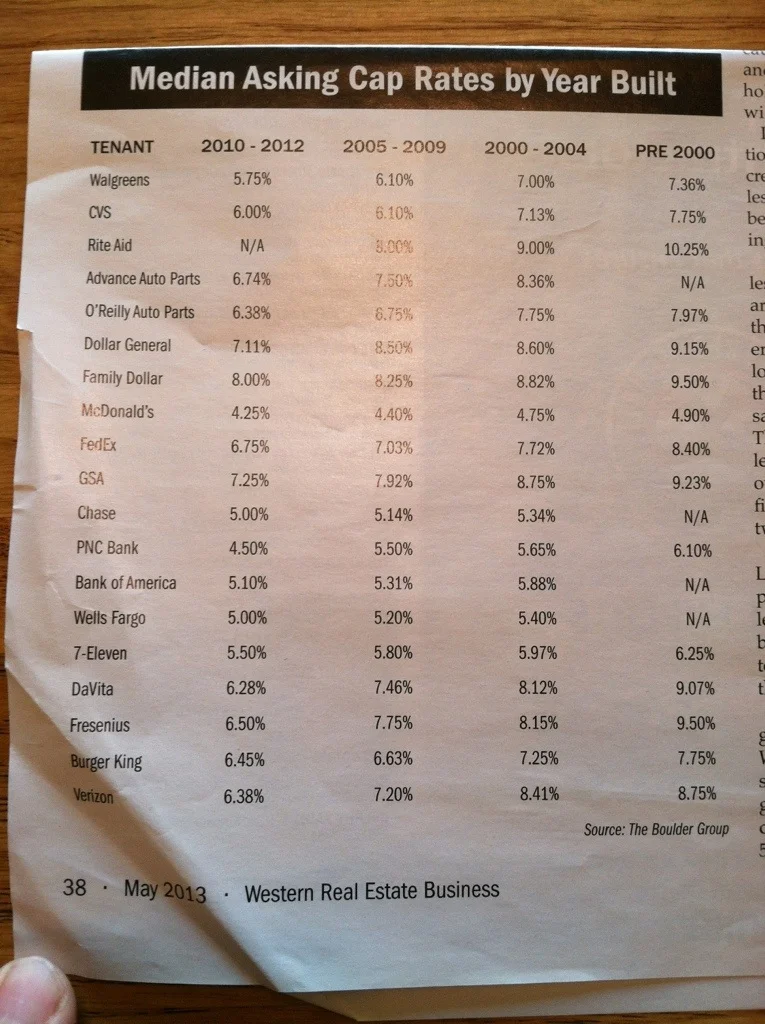

2. Lease Terms: While Starbucks leases are generally long-term, it's important to review the lease terms, rent escalations, and any clauses that might affect your investment's profitability.

3. Market Trends: Stay updated on market trends and Starbucks' performance as a business. This will help you gauge the sustainability of your investment over time.

Exploring Opportunities:

If you're eager to explore Starbucks NNN properties for sale, 1031 Navigator can be your trusted partner in this venture. With a dedicated team of experts in the field of NNN investments, they provide valuable insights, property listings, and guidance to help you make informed investment decisions.

Investing in Starbucks NNN properties can offer a stable and hassle-free source of passive income, backed by a globally recognized brand. The NNN lease structure, along with Starbucks' long-term stability, makes these properties an appealing choice for investors seeking both financial security and minimal management responsibilities. However, remember to conduct thorough due diligence and seek professional advice to ensure that your investment aligns with your financial goals. Start your journey towards Starbucks NNN investment success today with 1031 Navigator

Completing your 1031 exchange could be just a just a cup of coffee away!