NNN properties are a popular avenue for commercial real estate investment. These are typically single-tenant retail properties where the tenant is responsible for paying real estate taxes, providing their own property insurance and taking care of all property maintenance. Tenants take care of these expenses in addition to other monthly costs such as rent and utility payments. Part-time investors can find NNN properties to be an appealing real estate investment option. It offers a guaranteed stream of income from a real estate investment while also absolving the investor of carrying out many day-to-day management responsibilities for the property.

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can enjoy tax benefits that come from investing in commercial or residential real estate. Finally, successful NNN properties can act as a gateway for securing additional financing to use on other investments.

There are risks in leasing out triple net properties to the wrong tenant. An investor needs to know how to identify a good tenant versus a bad tenant. Assessing the worthiness of any tenant requires an investor to examine a company's business model and the state of its finances. Signing up a tenant in haste can result in disaster for any investor.

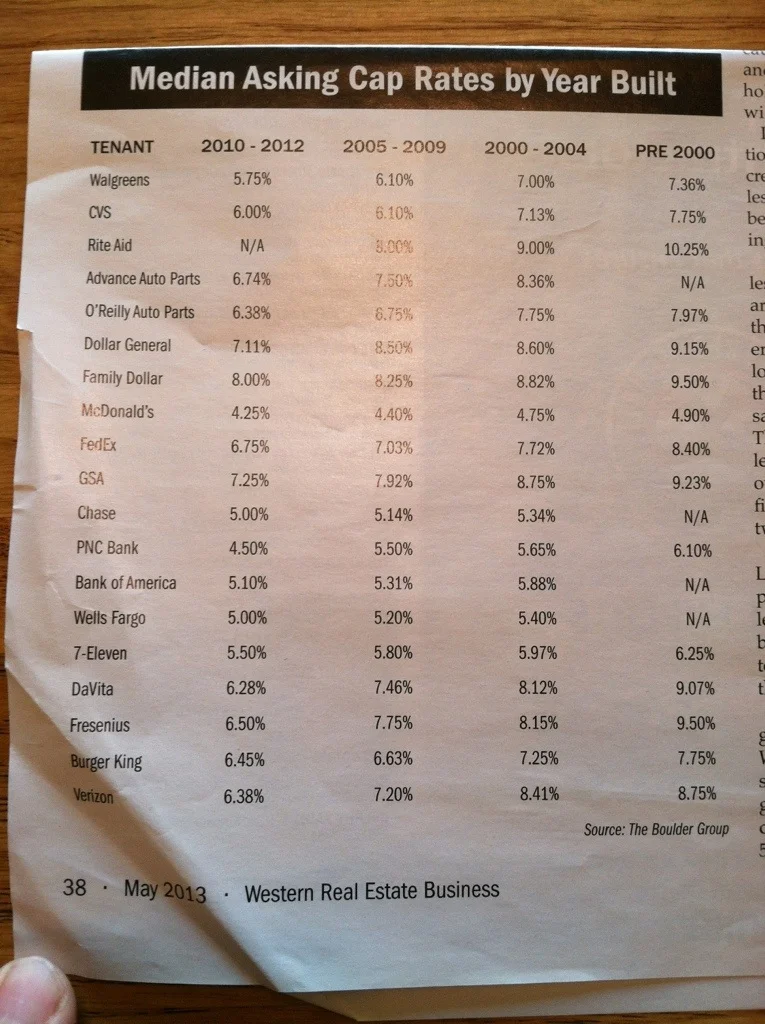

A company's credit rating offers an indicator of risk for default. While no investments outside of a federal bond offer a zero percent default rate, a tenant possessing an investment grade credit rating presents less of a risk for NNN properties.

Leasing NNN properties to a company essentially provides them capital. An investor needs to know if their tenant can guarantee long-term success with that capital. Investors should examine multiple criteria when choosing tenants for their triple net properties. They should examine a company's debt to equity ratio, operating margins, the number of stores it operates, the outlook for that industry and how the company is managed.

Investors in NNN properties should also take into account other factors. A successful investment can hinge on everything from location and building size to economic conditions for a particular industry. Triple net properties work best for a smart investor who buys in the right location and selects a low-risk tenant.

Knowing local market conditions is essential for any serious investor. It is important to pay attention to everything from the employment rate to median income in a community before selecting a property. A bad investment can leave an investor with an empty building that is essentially a money pit.

In the end, NNN properties are a great passive income investment that produce low risk yields of 7% or more with little investor oversight and involvement. Contact Thomas to find out more about NNN properties or to buy/sell a NNN property: 1-866-539-1777 or e-mail.