What nearby deal is a good NNN real estate investment?

TMO plays a game of deal roulette and looks at a net leased NNN Dunkin Donuts property for sale with 9 years on a absolute triple net lease.

It is a nice NNN building in downtown Phoenix, an attractive piece of real estate. It features a great location on 16th St and Bethany Home Road NNN Dunkin Donut For Sale which is quite a busy intersection with high traffic volume and a number of other properties nearby.

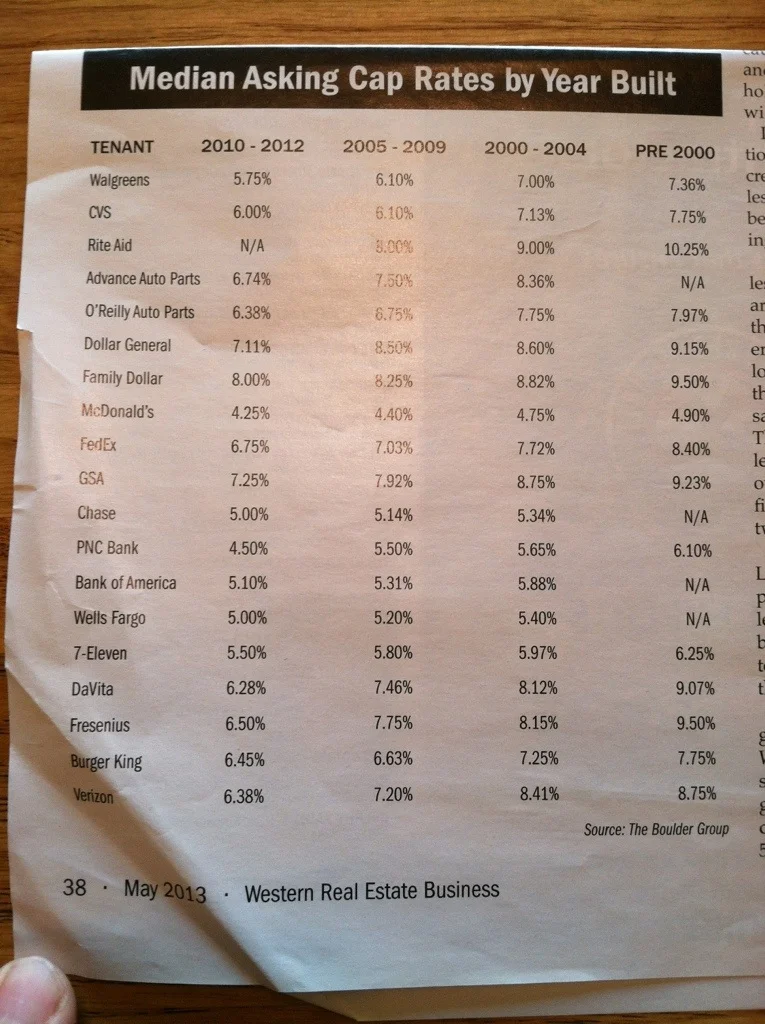

However, it has pretty aggressive cap rate and high per square foot rate, but it looks like it could be a good deal.

The price is $2,375,000

Deal Roulette rating is A- to B+.

99 Pitfalls and Mistakes of 1031 Exchanges

Make sure you don't mess up your 1031 exchange.

Learn about the common 1031 mistakes and errors people have made.

About the NNN Dunkin Donut For Sale Tenant:

Dunkin’ Brands Group, Inc., together with its subsidiaries, owns, operates, and franchises quick service restaurants under NNN Dunkin’ Donuts worldwide. The company operates in four segments: NNN Dunkin’ Donuts U.S., NNN Dunkin’ Donuts International, Baskin-Robbins International, and Baskin-Robbins U.S. Its restaurants offer hot and cold coffee, donuts, bagels, muffins and sandwiches, hard-serve ice cream, frozen beverages, baked goods, and other products. As of February 10, 2014, the company had approximately 11,000 Dunkin’ Donuts restaurants and 7,300 Baskin-Robbins restaurants, which are primarily owned and operated by approximately 2,000 franchisees, licensees, and joint venture partners. Dunkin’ Brands Group, Inc is publicly traded on the NASDAQ (DNKN) with a market capitalization in excess of $4.5 billion.