NNN 1031 Investments - Tractor Supply Company TSC Deals

Here is a quick video from the 1031 Exchange Passive Income & Investment Series about NNN Tractor Supply Investments.

Investing in TSC NNN Deals - Thomas takes a look at Tractor Supply Triple Net property investments for 1031 Exchanges.

FREE 1031 NNN CONSULTATION

Speak with our founder: Thomas Morgan, CCIM Click to ClaimWill you outlive your money?

The Pros and Cons of Triple Net Properties

In some ways, triple net properties are as much fixed-income investments as they are real estate vehicles.

Offering little to no management responsibility and long-term fixed incomes with the potential for gradual increases, they act like bonds.

However, underlying their financial structures, NNN properties are still real estate and carry the same eventual risks and challenges.

Here are some of the pros and cons of triple net lease properties:

Pro: Stable Income

Con: Limited Upside

Triple net leases are usually structured with a flat rent or with fixed increases. When you buy a $2,000,000 property at a 7.5 percent cap, you know that you can count on $150,000 per year for the life of the lease. Many triple-net properties also have rent increases of 1 to 2 percent per year built-in. They provide some growth, but don't necessarily keep up with inflation. However, this is no different from buying a corporate, Treasury or municipal bond with a fixed rate of return.

Pro: Long-Term 100% Occupancy

Con: Risk of 100% Vacancy

Most triple net properties come on the market with a lease of at least 10 years, with some having initial terms as long as 25 years. This gives you a long time during which you don't have to worry about partial or full vacancy. The drawback is that when the lease does expire, it's an all-or-nothing proposition. The same occurs in the event of a tenant default, although careful due diligence before purchase can reduce the risk of this occurring.

Pro: Attractive Cap Rates

Con: High Price Relative to Underlying Value

Single tenant properties typically trade at attractive cap rates that are hundreds of basis points above comparable non-real estate investments. They're also frequently priced lower than more traditional investment real estate alternatives on a cap rate basis. A large portion of their value comes from their income stream, though, meaning that they could lose value when vacant or as their remaining lease term decreases.

Pro: No Management

Con: CapEx at Rollover

True triple net properties are structured so that the owner has no responsibilities whatsoever during the lease period, while others transfer some capital expenditures to the owner. In either case, the ownership experience is very different from traditional real estate. However, when the lease rolls over, owners have to get involved in the re-leasing process and in any necessary capital expenditures to prepare for a new tenant.

What do you see as the benefits and risk?

Or Contact Thomas Morgan, CCIM Triple Net NNN Broker at 1-866-539-1777

NNN Properties and Your Future

NNN properties are a popular avenue for commercial real estate investment. These are typically single-tenant retail properties where the tenant is responsible for paying real estate taxes, providing their own property insurance and taking care of all property maintenance. Tenants take care of these expenses in addition to other monthly costs such as rent and utility payments. Part-time investors can find NNN properties to be an appealing real estate investment option. It offers a guaranteed stream of income from a real estate investment while also absolving the investor of carrying out many day-to-day management responsibilities for the property.

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can enjoy tax benefits that come from investing in commercial or residential real estate. Finally, successful NNN properties can act as a gateway for securing additional financing to use on other investments.

There are risks in leasing out triple net properties to the wrong tenant. An investor needs to know how to identify a good tenant versus a bad tenant. Assessing the worthiness of any tenant requires an investor to examine a company's business model and the state of its finances. Signing up a tenant in haste can result in disaster for any investor.

A company's credit rating offers an indicator of risk for default. While no investments outside of a federal bond offer a zero percent default rate, a tenant possessing an investment grade credit rating presents less of a risk for NNN properties.

Leasing NNN properties to a company essentially provides them capital. An investor needs to know if their tenant can guarantee long-term success with that capital. Investors should examine multiple criteria when choosing tenants for their triple net properties. They should examine a company's debt to equity ratio, operating margins, the number of stores it operates, the outlook for that industry and how the company is managed.

Investors in NNN properties should also take into account other factors. A successful investment can hinge on everything from location and building size to economic conditions for a particular industry. Triple net properties work best for a smart investor who buys in the right location and selects a low-risk tenant.

Knowing local market conditions is essential for any serious investor. It is important to pay attention to everything from the employment rate to median income in a community before selecting a property. A bad investment can leave an investor with an empty building that is essentially a money pit.

In the end, NNN properties are a great passive income investment that produce low risk yields of 7% or more with little investor oversight and involvement. Contact Thomas to find out more about NNN properties or to buy/sell a NNN property: 1-866-539-1777 or e-mail.

How to Select the Best Triple Net Broker

Given that a net-leased investment typically costs millions of dollars, finding a good triple net broker is particularly important. Working with a good triple net broker will give you better access to inventory, better financing, and a better investment result.

Here are a few things to look for in your quest for a top-line triple net broker.

Fundamental Knowledge

Many of the triple net broker firms in the market lack a solid understanding of the fundamentals of an NNN investment. Look for a triple net broker who knows the difference between a double net, a triple net, and a "true" triple net lease. Your triple net broker should also understand the credit rating system, as this will help them, and you, measure the risk of a given tenant.

Access to Inventory

A strong NNN broker will have a large and diverse inventory consisting of a mixture of their own listings as well as properties offered by other triple net broker companies and off-market deals. This will let you choose from a number of different properties to find the right mix of lease terms, lease length, and tenant quality.

Access to Financing

A good triple net broker knows that the lender can make or break the deal. As such, you should look for a triple net broker who either has an in-house commercial mortgage broker or a strong relationship with an outside broker. Your triple net broker should also understand the many different financing options available, including bank financing, life insurance financing, conduit debt and the "CTL" credit tenant lease programs that provide long-term fixed rate debt for NNN assets.

Client-Focused Business

Your triple net broker should take some time to get to know you and your goals. They should then show you appropriate property. If, for instance, you express a desire to have long-term stable income and your triple net broker shows you properties with five or fewer years remaining on the lease, you may want to select someone else. Watch for a NNN broker who does not attempt to saddle you with more debt than you want. Although some debt carries a number of benefits, it also carries risk, and a good triple net broker will help you strike the right balance.

Experience

Your triple net broker should have a few deals under his or her belt. Although some of the most active triple net broker teams in the company focus on seller representation, there are a large number of good buyer representatives who have amassed a large resume of experience. Work with a triple net broker like that, and if they have a well-respected designation, like CCIM, that is an additional plus.

What is Triple Net NNN? - Triple net lease definition

Is the Lease really a NNN Lease? - Triple Net Properties Q&A

Today we look at if the Lease is really triple net? Is it absolute net, triple net or double net?

In NNN investing, the lease is one of the most important things. The point of investing in NNN properties is to have a "hands off" investment.

When buying NNN properties make sure to read the lease to see if it is really true NNN or not.

Many triple net brokers and NNN sellers will advertise the lease as "net leased" or "ease of management" or "minimal landlord responsibilities" . Often times the lease will have more landlord responsibilities that advertised.

In this Video and Audio Q&A Thomas Morgan, CCIM of 1031navigator.com talks about absolute net leases, NNN leases, and NN leases.

Beware of opening escrow without having read the lease to see if it is triple net or not. This will save you time and money on your 1031 exchange NNN property purchase.

Video

Audio Version

Subscribe in iTunes or Stitcher

1031 Navigator helps investors nationwide find the best 1031 Exchange replacement properties in the shortest amount of time.

Our focused expertise, experience and daily triple net market presence enables clients to complete their 1031 Exchanges with peace of mind and certainty. 1031 Navigator has been involved with over half a billion dollars of 1031 Exchange NNN Properties in over 30 states.

1031 Navigator is a service of Andrus & Morgan Co., a national commercial and investment real estate brokerage specializing in passive income investments.

For a free, no-obligation 1031 Exchange NNN Property Strategy session for your 1031 Exchange visit:

http://www.1031navigator.com

Four New Tractor Supply Stores For Sale

5 Tips for Your Next Ground Lease Investment

Triple Net Properties News

Why are drug dealers the best tenants?

Deal Roulette - NNN Dunkin Donut in PHX

What nearby deal is a good NNN real estate investment?

TMO plays a game of deal roulette and looks at a net leased NNN Dunkin Donuts property for sale with 9 years on a absolute triple net lease.

It is a nice NNN building in downtown Phoenix, an attractive piece of real estate. It features a great location on 16th St and Bethany Home Road NNN Dunkin Donut For Sale which is quite a busy intersection with high traffic volume and a number of other properties nearby.

However, it has pretty aggressive cap rate and high per square foot rate, but it looks like it could be a good deal.

The price is $2,375,000

Deal Roulette rating is A- to B+.

99 Pitfalls and Mistakes of 1031 Exchanges

Make sure you don't mess up your 1031 exchange.

Learn about the common 1031 mistakes and errors people have made.

About the NNN Dunkin Donut For Sale Tenant:

Dunkin’ Brands Group, Inc., together with its subsidiaries, owns, operates, and franchises quick service restaurants under NNN Dunkin’ Donuts worldwide. The company operates in four segments: NNN Dunkin’ Donuts U.S., NNN Dunkin’ Donuts International, Baskin-Robbins International, and Baskin-Robbins U.S. Its restaurants offer hot and cold coffee, donuts, bagels, muffins and sandwiches, hard-serve ice cream, frozen beverages, baked goods, and other products. As of February 10, 2014, the company had approximately 11,000 Dunkin’ Donuts restaurants and 7,300 Baskin-Robbins restaurants, which are primarily owned and operated by approximately 2,000 franchisees, licensees, and joint venture partners. Dunkin’ Brands Group, Inc is publicly traded on the NASDAQ (DNKN) with a market capitalization in excess of $4.5 billion.

Deal Analysis: 1031 NNN Investment

These Passive Investments Pay You to Golf

Every wish you were a golf pro or could get paid to golf?

Get paid to do what you love.

At some point we all wish we could get paid to do what we love. (see: doing what you love while getting paid) Does it matter where the money comes from? Do you have to be Tiger Woods to get paid while you play golf? No. You can get paid by other sources while playing golf.

Passive investments allow you to be "passive" and collect money from the investments. A business is active and Tiger Woods is a business. He has to work to make money. He has to show up. He has to perform. Then he collects.

Tiger does have many passive parts to his business like his endorsements which allow him to collect money while doing other things besides playing golf. Regardless of his golf performance or his tabloid success Tiger Woods will be able to collect passive income for life just because he is Tiger Woods.

Unfortunately, you are not Tiger Woods.

However, you can still get paid to play golf.

Consider these passive real estate investments.

These triple net properties require little or no management and will pay you while you play golf, they will pay you while you travel, even pay you while you eat and sleep. The leases are triple net so the tenant takes care of pretty much everything and you collect the rent check.... while doing what you love.

These triple net properties pay you to do what you love.

Contact TMO for more details on passive real estate investments like these triple net properties:

Lowe's Net Leased Property $6,665,000 Excellent location across from a Walmart anchored retail corridor,Average Household income of $83,141 in 5mile radius,Absolute net lease, Attractive assumable financing requiring only $1.4M.

FedEx Net Leased Property $6,000,000 Cap rate 7.23% Fifteen (15) Year Lease, FedEx Corporate Guarantee (BBB), Expandable Facility

hhgregg Net Leased Property $6,143,000 8.50 % Situated on Major Retail Corridor with Over 78,000 Vehicles Daily, Irreplaceable Retail Location with Outstanding Residual Value, Growing, Publicly Traded Regional Retailer with 174 Store Network

Orchard Supply Hardware Net Leased Property $11,110,000 Cap Rate 7.5% Rent increase by 11% in 2014, Primary lease, The Kroger Co - S&P rated BBB, Assumable $7.5 million loan

Starbucks Plaza Net Leased Property $4,604,000 8.20% Cap Rate 100% Occupied Strip Center with historically low vacancy. Mix of national, regional and local tenants, heavily Trafficked, Signalized Intersection Location.

National Tire and Battery Net Leased Property $ 3,668,000 Cap Rate: 7.50% Brand New 20-Year Lease with National Tire and Battery.Cpi increases every Five year with max of 12 persent. New sweven year lease with American mattress. average household income in 1 mile radius - $129,000. over 11800 resident in 5 miles.

Contact TMO for more details on any of the above passive investments and net leased NNN property deals via email or phone at 1.866.539.1777

Deals are a sampling of available NNN inventory from around the US and are for reference only.

NET LEASED PROPERTIES for sale

Top 5 Reasons to Obtain a Land Survey

Guest Post by Will Schnier, P.E., President of BIG RED DOG Engineering | Consulting

There are many reasons why somebody purchasing property would want to obtain the necessary survey products. For this discussion, at a minimum, I recommend that you should always obtain a current title survey, based on a title commitment less than 30-days old. A title survey will include information regarding property lines, location of improvements, easements, utilities and other conditions affecting the property.

I would also suggest that you consider obtaining a full tree, topography, and boundary survey in addition to the title survey if it’s appropriate for your purchase and project/investment intentions. The tree, topography, and boundary survey is also referred to as a design survey, and may be used by an engineer or architect to develop site development and building plans.

My top five reasons for you to obtain a survey are as follows:

1.) Know what you’re buying – the survey will identify the exact limits of the property boundary and improvements on the property.

Real estate can have title and boundary disputes (unfortunately it’s more common than you’d expect), which a title survey would help to uncover. Furthermore, relying upon tax district information on the lot or building size, or seller furnished documentation can be a recipe for expensive trouble without proper due diligence.

2.) Discover the presence and exact location of any easements, restrictions, or other encumbrances that may be imposed upon the property.

You may look out on a piece of property and see a green field, or a paved parking lot, and simply assume that that land is available for you to develop easily. How does that change if there are drainage or utility easements in that location? You may still be able to develop, yes, but your cost just went up a lot more than the cost of the survey.

Or suppose, you’re out in the county, not under the jurisdiction of a municipality that can impose zoning and land use restrictions. So you can build what you want right? What if a former owner of the property restricted its use, in an effort to promote a certain type of community? That 10-acre tract you intended to use for your commercial construction business may not be feasible if there is a deed restriction from 30 years ago limiting the use of the property to residential.

3.) If you’re spending significant money, it makes sense to an additional thousand or few thousand on a title and design survey.

Obtaining a title survey is an affordable way to obtain some more peace of mind with the transaction. Don’t be penny-wise and pound-foolish. You should do everything you can to protect the investment you’re making. A title survey could be as little as $1,000.

4.) The title and/or design survey can be used in the future to prepare drawings and exhibits, and to apply for building permits.

If you’re buying an office building for example, your prospective tenants may ask for a site plan showing the parking locations on the property – well now you have a survey you can supply them. Suppose again you want to apply for a minor building permit to expand the same office building - having a survey in hand will be a necessary step in that process.

5.) You can make the other guy pay!

All real estate contracts, residential or commercial, contain a clause specifically assigning the cost of the tile survey to either the buyer or the seller. Check the box next to the other guys name; this point is rarely an issue of significant contention during the negotiation process.

For more reading, I would encourage you to visit the BIG RED Blog. On you blog you will find very useful information on the land subdivision and site development permitting process, and highlights of specific BIG RED DOG projects, such as our new downtown Austin hotel at 416 Congress Avenue.

About Will Schnier, P.E.:

Will Schnier is the President of BIG RED DOG Engineering | Consulting. He has been responsible for the project management, engineering design, and regulatory permitting of numerous multifamily residential, retail, office, and industrial site development projects throughout central Texas. He can be reached by email at Will.Schnier(atsign)BIGREDDOG.com or by phone at (512) 669-5560.

About BIG RED DOG Engineering | Consulting:

BIG RED DOG is an Austin, Texas-based civil engineering firm specializing in land development engineering, permitting, and land use consulting. Our team of professional civil engineers and certified land planners has over 100-years of combined experience in the Austin and central Texas market. Our commercial project experience includes multi-family, hotel, office, industrial, retail, and single-family subdivision development projects throughout central Texas.

Passive Investments: 5 Net leased deals that caught my eye

Here are 5 Net leased deals that caught my eye this past week as great passive investments....

Starbucks Texas $1,120,000 7.5% "BBB+" Credit Rating, Out parcel to 191,000 SF Ross & Bealls Anchored Center

NNN AT&T Strip Center Raleigh, NC $4,744,800 Retail shopping center in Raleigh, North Carolina.

AutoZone Office Building CA (Sacramento) $15,700,000 6.64% Autozone Net Leased Office Building Guaranteed by AutoZone, Inc (NYSE: AZO). S&P Rated BBB investment In Rent Class A Build-to-Suit Completed in 2009. Mission Critical Facilty-Headquarter of ALLDATA,Wholly Owned Subsidiary of Autozone.

AT&T Zachary, LA $19,03,000 8% 10 Year Lease (2011 Construction) 10% Increase Every Five year "A" Standard and Poor Credit Rating

Whirlpool Distribution Building Omaha, NE $2,200,000 8.75% Incredible location in one of Omaha’s top Industrial park’s near 96th and L street.

Contact Thomas Morgan, CCIM for more details on any of the above passive investments and net leased NNN property deals via email or phone at 1.866.539.1777

Deals are a sampling of available NNN inventory from around the US and are for reference only.

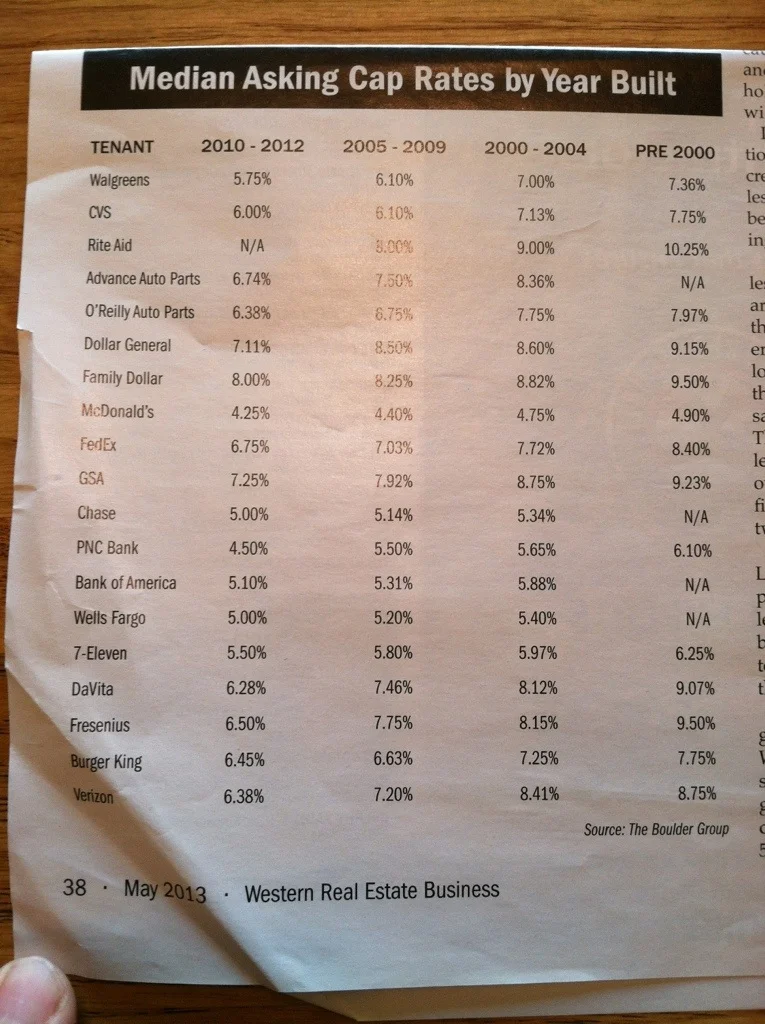

Current NNN Cap Rates

Here is a great chart of current asking cap rates for single tenant NNN deals. It is sorted by NNN tenant and NNN year built. Originally published in Western Real Estate Business May 2013. Data by Boulder Group.

"Ignore the Recession" - More reasons to buy a Net Leased TSC

TSC is one of my favorite NNN tenants. Nice buildings, great locations, solid financials, long leases, low management for owners; the list goes on and on. ABC News Nightline did a segment this week of why TSC is a "Recession Proof Retailer". TSC's internal strategy has been to "ignore the recession". It appears to have worked.